July 2025 Calgary & Area Real Estate Market Summary

July 2025 Calgary Real Estate Market Summary – City, Districts & Property Types

Source: CREB Calgary Monthly Statistics Package (PDF)

City of Calgary

| Metric | Value |

|---|---|

| Sales | 2,099 |

| New Listings | 3,911 |

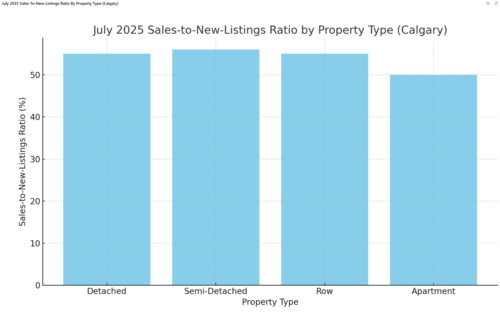

| Sales to New Listings Ratio | 54% |

| Inventory | 6,917 |

| Months of Supply | 3.30 |

| Benchmark Price | $582,900 |

| Average Price | $616,686 |

| Median Price | $569,500 |

In July 2025, Calgary saw 2,099 residential sales, a 12% decline from July 2024. Inventory climbed to 6,917 units, marking the highest July supply since pre-pandemic levels. Increased listings, particularly in newer communities, expanded choice but eased price momentum. The citywide benchmark price settled at $582,900 (–4% Y/Y), reflecting supply-side pressures on apartments and row homes, while detached and semi-detached prices remained relatively stable.

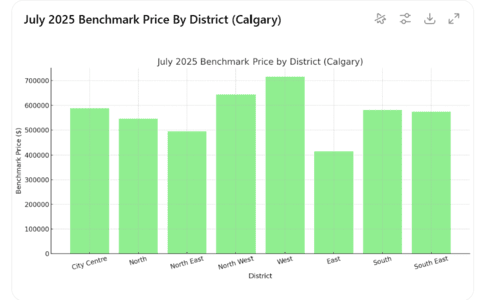

Benchmark Prices by District

| District | Benchmark Price |

|---|---|

| City Centre | $588,000 |

| North | $545,700 |

| North East | $494,400 |

| North West | $643,400 |

| West | $716,000 |

| East | $414,600 |

| South | $581,100 |

| South East | $573,300 |

District-level price trends varied across Calgary. The West ($716,000) and North West ($643,400) districts posted the highest benchmarks, while East Calgary remained the most affordable at $414,600. Most districts held steady or posted modest gains, but areas like the North East and East saw benchmark declines of up to 5% Y/Y, largely due to supply influx.

Market by Property Type

| Property Type | Sales | New Listings | Ratio | Inventory | Months Supply | Benchmark Price |

|---|---|---|---|---|---|---|

| Detached | 1,031 | 1,888 | 55% | 3,078 | 2.99 | $761,800 |

| Semi-Detached | 187 | 331 | 56% | 549 | 2.94 | $697,500 |

| Row | 373 | 678 | 55% | 1,193 | 3.20 | $446,200 |

| Apartment | 508 | 1,014 | 50% | 2,097 | 4.13 | $329,600 |

Detached: With months of supply at 3, detached homes remained in a balanced market. Benchmark prices dipped slightly to $761,800 (–1% Y/Y).

Semi-Detached: Semi-detached homes stayed stable with a benchmark price of $697,500 (+1% Y/Y), backed by low inventory in key districts.

Row Homes: Increased supply (3.2 months) pushed row home prices down to $446,200 (–4% Y/Y), especially in North East and North districts.

Apartments: Rising competition from new builds and elevated inventory (4.13 months supply) brought apartment benchmarks down to $329,600 (–5% Y/Y).

© 2025 Diane Richardson. All information herein deemed reliable but not guaranteed.

Comments:

Post Your Comment: